BADGER METER (BMI)·Q4 2025 Earnings Summary

Badger Meter Beats But Guides Soft — Stock Plunges 13% After Hours

January 28, 2026 · by Fintool AI Agent

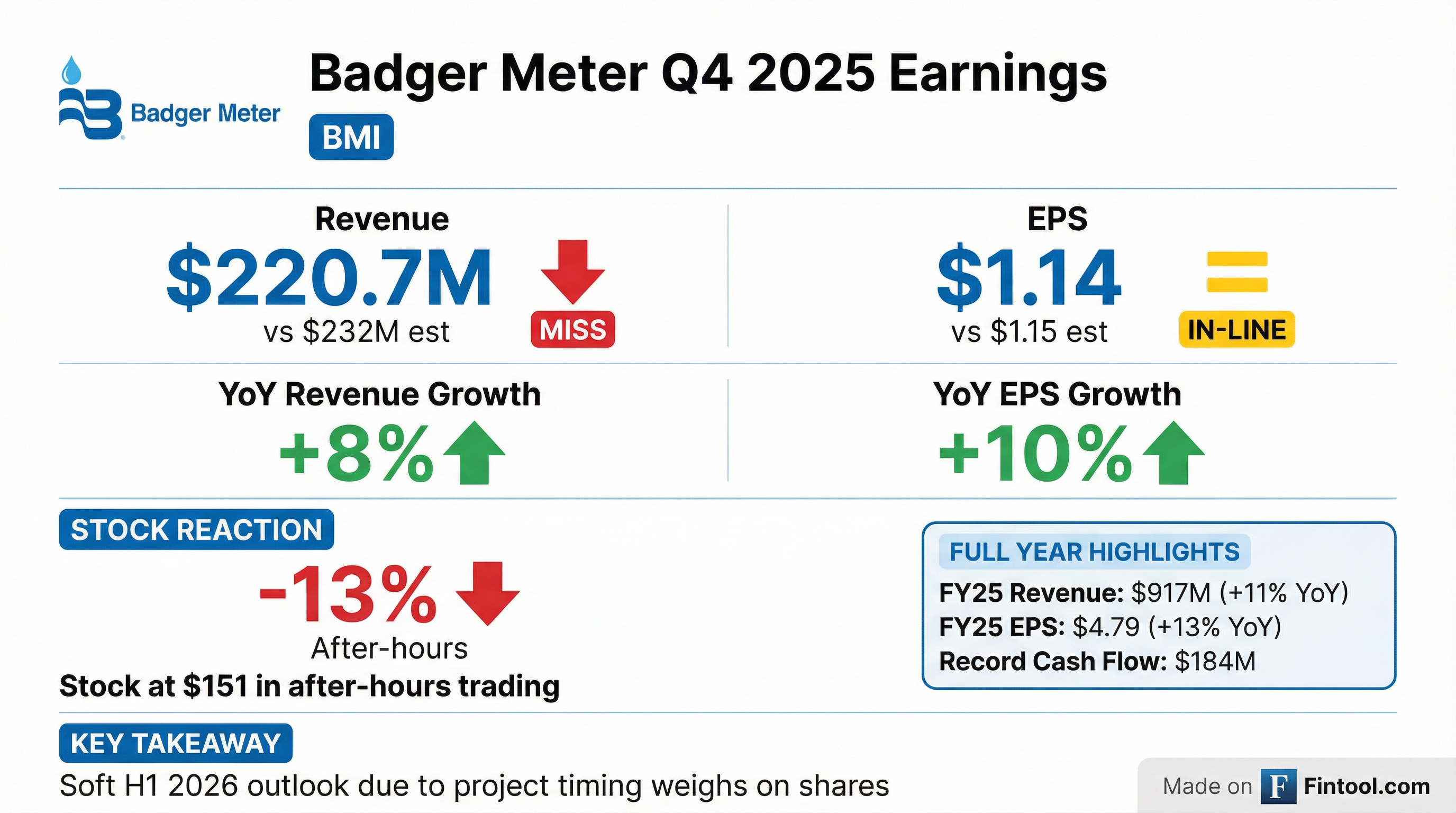

Badger Meter reported Q4 2025 results that showed solid year-over-year growth but missed Street expectations on revenue. More importantly, management's outlook for H1 2026 spooked investors, warning that concluding AMI projects would result in below-trend growth until new deployments ramp. The stock dropped 13% in after-hours trading to $151.

Executive Transitions

The Q4 call marked leadership transitions:

- Dan Weltzien became CFO on January 1, 2026, after 7 years as VP and Controller

- Bob Wrocklage, the former CFO, transitioned to EVP North America Municipal Utility to lead Badger Meter's largest business segment

Did Badger Meter Beat Earnings?

Short answer: Mixed. Revenue missed, EPS was roughly in-line, but the outlook drove the stock reaction.

The revenue miss was driven by Base utility water sales growing just 2% YoY in Q4, a significant deceleration from 8% in Q3 and 5% in Q2 . Management attributed this to the concentrated timing of concluding AMI turnkey projects.

What Did Management Guide?

Near-term caution, long-term confidence unchanged.

CEO Ken Bockhorst delivered the key message that's weighing on shares:

"The second half of 2025 included a concentrated mix of concluding AMI turnkey projects, resulting in Base revenue growth that was lower than our five-year forward outlook. Looking ahead, we expect this dynamic to persist through the first half of 2026, until several awarded projects begin multi-year turnkey deployments."

However, management reiterated their five-year forward outlook:

- High single-digit organic sales growth

- Year-over-year operating margin expansion

- Free cash flow conversion >100% of earnings

The Puerto Rico (PRASA) AMI project — one of the world's largest deployments covering 1.6 million service connections — was highlighted as evidence of the robust pipeline. CEO Ken Bockhorst put the scale in perspective:

"To give it some reference... we never announced the win and the project that we did recently complete in Orlando. So everyone's aware Orlando is a pretty large city. To put it in scope and scale, the PRASA award is the equivalent to 8 Orlandos."

Management provided a detailed timeline: Badger Meter bid in 2021, completed a competitive pilot in 2023-2024, won the award in 2025, and expects deployment to begin in H2 2026 with a ~5-year rollout . Importantly, this is a supply-only contract (E-Series ultrasonic meters, ORION cellular AMI, BEACON SaaS) manufactured in Racine, WI to meet Buy American requirements tied to FEMA funding for Hurricane Maria recovery .

How Did the Stock React?

BMI has now declined on 4 of the last 5 earnings reports:

*After-hours move

The stock closed at $164.41 on January 27 (down 5.6% on the day) and dropped another 8% after hours to $150.99 following the release. This puts BMI down 41% from its 52-week high of $256.08.

What Changed From Last Quarter?

Base growth decelerated sharply. In Q3 2025, management had guided for normal seasonal headwinds in Q4 but emphasized "solid close to the year" . The 2% Base growth came in well below that tone.

The positive: Gross margins expanded to 42.1%, benefiting from favorable product mix (ultrasonic meters, cellular AMI, water quality, SmartCover) and lower pass-through installation revenue .

2026 Margin Headwinds: Management flagged that while they've reached price-cost parity on 2025 tariffs, they expect elevated copper prices and bialloy ingot material costs to be a gross margin headwind in 2026 . They continue to factor these inputs into their normalized 39-42% gross margin range and routine pricing actions.

Full Year 2025 Highlights

Despite the Q4 softness, FY25 was a record year:

SmartCover, acquired in early 2025, contributed approximately $40M in revenue over 11 months with nearly 25% pro-forma growth on an annualized basis . Manufacturing operations were successfully transferred from Escondido, CA to Racine, WI during the year. Kim Stoll will lead the SmartCover organization effective January 1, accelerating integration with Badger Meter's sales channel to drive municipal adoption of sewer and lift station monitoring through the BlueEdge suite . Management confirmed SmartCover is on track to achieve earnings accretion in 2026.

SaaS revenue (BEACON, SmartCover, and other software) reached 8.0% of total sales in FY 2025, up from approximately 7% in FY 2024 .

Market Position and Competitive Context

On the earnings call, management provided helpful framing on Badger Meter's market position:

When asked about a competitor's (implied Mueller) softer outlook, CEO Bockhorst pushed back on the read-through:

"We have several differences that have been built over the last several years. We have an industry-leading AMI offering that has several in-flight projects and awarded, not started projects. We've got a really exciting software business at 8% of our revenue now that's 100% recurring. We're really excited about what's happening with sewer line monitoring and water quality monitoring and network monitoring — these are things that, I believe the competitor you're talking about doesn't have."

Key Segment Performance

Utility Water (+9% YoY reported, +2% ex SmartCover in Q4):

- Base growth of just 2% driven by project timing and fewer operating days

- 6% sequential decline from Q3 to Q4 due to project pacing

- Ultrasonic meters, ORION cellular, BEACON SaaS, and water quality solutions remained strong

- SmartCover performing ahead of expectations

Flow Instrumentation (flat YoY in Q4):

- Modest growth across water-focused end markets

- Non-water applications remain de-emphasized

- Management guidance: GDP-like growth going forward

Margins and Profitability

Management raised their normalized gross margin range from 38-40% to 39-42% last quarter, reflecting structural mix benefits from higher-margin products . Q4 delivered at the high end of this range.

The 200 bps improvement in Base operating margin YoY demonstrates continued execution even as top-line growth moderates.

Capital Allocation

Badger Meter ended Q4 with:

- Cash: $226M

- Total Debt: $0 (net cash position ~$226M)

- Q4 Free Cash Flow: $50.8M (vs $47.4M in Q4 2024)

- FY25 Free Cash Flow: $169.7M (record, 120% of net earnings)

- Working Capital Intensity: Improved to 20.9% of sales (down from 26.5% in 2020)

Capital priorities remain unchanged: (1) organic R&D investment, (2) dividend growth (33 consecutive years), and (3) M&A.

Notably, management repurchased $15M in shares in Q4 when "the market price implied an attractive long-term return on capital" . CEO Bockhorst hinted at continued buybacks: "If we thought it was attractive in Q4, I'm not forecasting anything for you, but I would think you'd think we'd think it's attractive now, too."

Q&A Highlights

On Project Timing Confidence:

"These aren't hoping for backlog increases. These aren't hoping for things to happen. These are known, awarded, not started projects, that even if they have some variability in where they move, they're in our pocket."

On 2026 Shape:

"I would think about 2026 as the inverse effect of 2025... I would just expect a lower growth rate in the first half of the year, and a higher growth rate in the second half."

On Pricing Strategy (Tariffs):

"We do list price increases. What we didn't do was temporary tariff add-ons or tariff issues that could be challenged in court or could be reversed... ours is pretty clean, I think, compared to how other people have handled the pricing aspects of tariffs."

On Federal Funding Concerns:

"When speaking directly with our customers, we have not seen meaningful evidence that real or perceived federal funding constraints will impact our ability to generate high single-digit sales growth."

On PRASA Manufacturing Location (Racine vs Mexico):

"The location of manufacture is being driven by U.S.-made manufacturing requirements. That's part of the reason why we made an investment in that facility and continue to invest there... we understand that cost footprint, and we're able to embed that into the RFP process."

On SmartCover Growth Potential:

"We're still so early in adoption of sewer line monitoring, that there's still so much more room to grow... before we acquired it, it was growing at a 20% CAGR for multiple years."

On AMI as Platform:

"AMI becomes an implementation that... a utility grows into having data availability and the insights and analytics to influence how they run... Once that capability is in place, it then becomes very clear that marrying up that meter and flow data with other pressure management and/or water quality data becomes a very valuable value proposition."

On Project Delays Not Funding-Related:

"When Ken says a project slides to the right, it's not related to funding. Each one of these projects is different. Every customer is different. There's contracting phases, there's initial deployment areas, there's full rollout. So there's multiple steps to these projects." — Dan Weltzien, CFO

What Did Management Avoid Discussing?

Management did not provide specific 2026 revenue or EPS guidance, consistent with their policy. The five-year outlook framework makes it difficult for investors to model near-term expectations, particularly given the acknowledged H1 2026 headwinds.

There was also limited discussion of tariff impacts in the Q4 release, though this had been a focus in prior quarters. The new 39-42% gross margin range was designed to account for "all currently known trade and tariff conditions" .

Forward Catalysts

Potential Positives:

- PRASA Puerto Rico deployment (1.6M connections, supply-only) beginning H2 2026

- SmartCover turning EPS accretive in year two (FY26)

- New awarded projects ramping in H2 2026

- Continued SaaS penetration (now 8% of sales, ~27% CAGR)

- Inaugural Investor Day on May 21, 2026 in New York City

Risks to Monitor:

- H1 2026 growth could disappoint further if project awards slip

- Federal funding uncertainty for utility infrastructure

- Tariff/trade policy changes impacting input costs

- Valuation compression if growth outlook moderates

Conference Call Details

Badger Meter will host its Q4 2025 earnings conference call on January 28, 2026 at 10:00 AM Central / 11:00 AM Eastern. The call will be webcast at investors.badgermeter.com.

Upcoming Dates:

- Q1 2026 Earnings: Tentatively scheduled for April 16, 2026

- Inaugural Investor Day: May 21, 2026 in New York City

Related Resources: